Addition of EMC's Storage Products Will Extend Dell's Reach into Enterprise Market As Public Cloud Services Gain Ground

In a deal worth more than $60 billion — apparently the largest pure IT acquisition in history — Dell has signed a deal to buy EMC. The move is meant to give the companies a better position in burgeoning markets including software-defined data centers and hybrid cloud infrastructure.

The purchase is being backed by investment firm Silver Lake, and will involve payments to EMC shareholders of cash and a tracking stock reflecting EMC's share of VMware, which will continue to be publicly traded. Based on current valuations of VMware, Dell said, the total value of the deal will be around $67 billion. The transaction is expected to close in mid 2016, the company said.

Complementary Component

In a conference call with analysts, Dell Chairman and CEO Michael Dell cited "complementary" products, sales teams, and R&D strategies at the two companies, saying the combination would give them better access to an information technology market he valued at $2 trillion.

"As the data market moves to a compute-centric, converged model, Dell's server franchise is a natural fit with EMC's strengths," he said. "We are harnessing Dell's server PC and go-to-market strength in the mid market with EMC's go-to-market strength in the large enterprise market to better serve customers and to fuel profitable growth and generate significant cash flow."

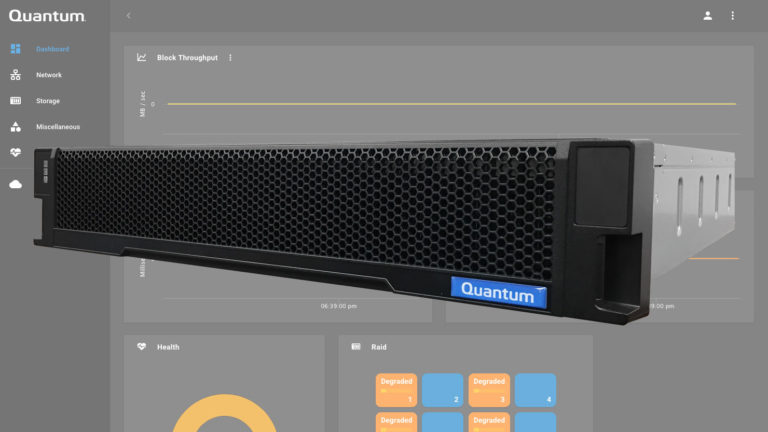

In other words, Dell sees the EMC acquisition as a way to go end-to-end, selling its PCs and servers to a broader range of enterprise customers who appreciate EMC's marquee products, such as its Isilon line of scale-out NAS products. Dell has been under pressure as the overall PC market continues to decline, and EMC has faced competition from a new generation of hosted services — specifically Amazon Web Services, the public cloud's 800-pound gorilla — that are siphoning off business from the traditional storage industry.

Competing with Public Cloud Services

The move represents a victory for Michael Dell, who took his company private in 2013 with the intention of moving more nimbly and diversifying its offerings. What remains to be seen is how EMC and Dell's strategy and solutions will stack up when it comes to competing with the new breed of public cloud providers — Amazon, Google and Microsoft will not be pushovers. With a dominant position in the virtualization software market, VMware is a key asset in this space, and what role it may eventually play in a Dell/EMC private cloud ecosystem is an open question.

Keeping an East Coast Presence

There was no word today of reorganizations or layoffs at the companies, with executives stressing that the deal will close sometime between May and October 2016, but EMC Chairman and CEO Joe Tucci said the combined entity will maintain a significant presence in EMC's current headquarters in Hopkinton, MA. "This new, combined company will have three major hubs in the U.S.," he told analysts. "There will be thousands of people in Austin, and thousands of people in Silicon Valley, and thousands of people in Boston. We're going to house the biggest business in the new company, the biggest business at EMC, here in Hopkinton. We anticipate that will start out life at over $30 billion."

And any story on the deal should include a footnote. As reported by Reuters, the merger agreement includes a "go shop" provision that gives EMC 60 days to solicit bids from other companies, meaning another entity could still swoop in and break up the party.

Did you enjoy this article? Sign up to receive the StudioDaily Fix eletter containing the latest stories, including news, videos, interviews, reviews and more.